Exchange Subsidies

Can you explain how subsides work?

Hidden content

Who is eligible for Marketplace premium subsidies?

Hidden content

Will there be subsidy only doctors?

Hidden content

Am I eligible for financial aid on an exchange?

Hidden content

Exchange Eligibility

What is the Health Insurance Marketplace?

Hidden content

How long after I enroll in a plan will coverage take effect?

Hidden content

When can I enroll in private health plan coverage through the Marketplace?

Hidden content

I live in one state, but drive across the border every day to work in a different state. What Marketplace should I use to buy coverage?

Hidden content

I’m eligible for health benefits at work but want to see if I can get a better deal in the Marketplace. Can I do that?

Hidden content

I just moved from State A to State B. I don’t have a permanent home yet, am staying with a friend until I find a job and can get settled, but I need health insurance right away. How can I establish/document residency in State B?

The fact that you don’t have a permanent home should not affect your eligibility in State B as long as you are currently residing there and intend to remain there. In most cases, the Exchange will accept an applicant’s statement regarding their state of residence without other verification. In situations where other information available to the Exchange suggests that the applicant may live in a different state, it may ask for verification. This could happen in your case if records available to the Exchange show your prior address in State A. You will need to provide a statement or other documentation showing that you have moved and now intend to reside in State B.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Do I need to be on the same plan as my spouse?

No. There is no requirement in the Affordable Care Act that spouses be on the same plan. But, if you want to qualify for a premium tax credit, or subsidy, to lower the cost, be aware that subsidies are based on your total household income level. So, even though your spouse will not be covered by the subsidized insurance plan, their income will be calculated when determining the level of subsidy your eligible for.

https://www.ehealthinsurance.com/affordable-care-act/faqs

Can I buy a plan in the Marketplace if I don’t have a green card?

If you are not a U.S. citizen, a U.S. national, or an alien lawfully present in the U.S., you are not eligible to buy a plan on the health insurance marketplace. However, you can shop for health insurance outside of the Marketplace in the non-group market. Insurers outside of the marketplace are prohibited from turning you down based on your health status or your immigration status and must follow generally the same rules as plans in the marketplace.

Adapted from http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Where can I go to learn more about my state’s exchange?

To find out where to access information about your State Exchange, go to our web page http://________ and select your state to learn more about the Exchanges.

I’ve never had insurance; how do I know what plan I should pick?

Your state exchange/marketplace has people, called Navigators, who are there to help walk you through the shopping process. They can help you compare plans and ask questions to help you find the right fit for you. Or, you can work with your broker, if you have one, to find out more about plans available to you.

Finding A Physician

How can I find out if my doctor is in a health plan’s network?

Each plan sold in the Marketplace must provide a link on the Marketplace web site to its health provider directory so consumers can find out if their health providers are included. The provider network information that insurance companies provide may or may not tell you whether a provider is accepting new patients, or whether a provider speaks your language. It is up to your Marketplace to require insurers to provide you with this information.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

What happens if I end up needing care from a doctor who isn’t in my plan’s network?

Plans are not required to cover any care received from a non-network provider, though many plans today do, at least to some extent. If you do receive care out of network, it could be costly to you. Generally plans that provide an out-of-network option cover such care at a lower rate (eg, 80% of in-network costs might be reimbursed but only 60% of non-network care.) In addition, when you get care out of network, insurers may apply a separate deductible and are not required to apply your costs to the annual out-of-pocket limit on cost sharing. Non-network providers also are not contracted to limit their charges to an amount the insurer says is reasonable, so you might also owe “balance billing” expenses.

Adapted from http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Can I still see my doctor next year?

In most cases, access to doctors will work much like it does today. Health insurance plans will contract with networks of doctors, specialists and hospitals. And, as long as your doctor is contracted with the plan that you are part of, there is no reason to believe that your doctor will stop taking appointments.

https://www.ehealthinsurance.com/affordable-care-act/faqs

However, some doctors are not particularly happy with the reimbursement that they are receiving from Marketplace plans so you should check with your physicians’ offices once you have narrowed the choice of plans that you are considering-to ensure that they are in the plan network.

Exchange Plans

What health plans are offered through the Marketplace?

All health plans offered through the Marketplace must meet the requirements of “qualified health plans.” This means they will cover essential health benefits, limit the amount of cost sharing (such as deductibles and co-pays) for covered benefits, and satisfy all other consumer protections required under the Affordable Care Act.

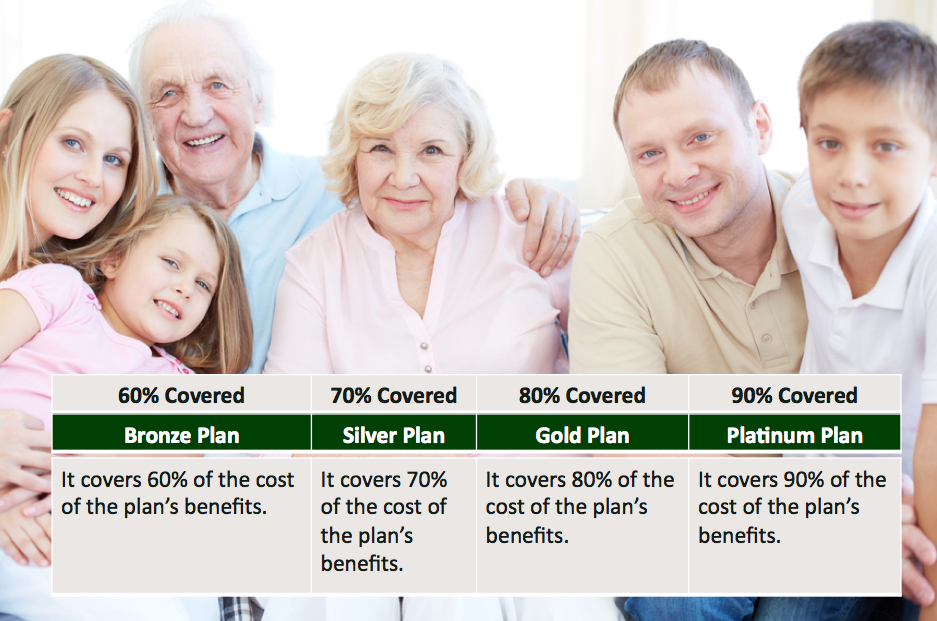

Health plans may vary somewhat in the benefits they cover. Health plans also will vary based on the level of cost sharing required. Plans will be labeled Bronze, Silver, Gold, and Platinum to indicate the overall amount of cost sharing they require. Bronze plans will have the highest deductibles and other cost sharing, while Platinum plans will have the lowest. Health plans will also vary based on the networks of hospitals and other health care providers they offer. Some plans will require you to get all non-emergency care in-network, while others will provide some coverage when you receive out-of-network care.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I notice Marketplace plans are labeled “Bronze,” “Silver,” “Gold,” and “Platinum.” What does that mean?

Plans in the Marketplace are separated into categories — Bronze, Silver, Gold, or Platinum — based on the amount of cost sharing they require. Cost sharing refers to health plan deductibles, co-pays and co-insurance. For most covered services, you will have to pay (or share) some of the cost, at least until you reach the annual out of pocket limit on cost sharing. The exception is for preventive health services, which health plans must cover entirely.

In the Marketplace, Bronze plans will have the highest deductibles and other cost sharing. Silver plans will require somewhat lower cost sharing. Gold plans will have even lower cost sharing. And Platinum plans will have the lowest deductibles, co-pays and other cost sharing. In general, plans with lower cost sharing will have higher premiums, and vice versa.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

What do Metallic Plans cost?

The metallic level helps shoppers understand the level of coverage a plan offers – how much they will need to pay and what the plan pays.

The metallic plan category you choose affects the total amount you’ll likely spend for essential health benefits during the year. The percentages the plans will spend, on average, are:

- 60 percent (Bronze),

- 70 percent (Silver),

- 80 percent (Gold), and

- 90 percent (Platinum)

This isn’t the same as coinsurance, in which you pay a specific percentage of the cost of a specific service.

Platinum plans typically mean that you will pay less for medical services, but your monthly premium will be higher. With a bronze plan, on the other hand, you will typically pay more for medical services, but your monthly premium will be lower.

Adapted from http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I signed up for a Bronze plan with a high deductible during Open Enrollment. Now, six months later, I need surgery and would rather be in a different plan with a lower deductible. Can I change plans?

• No, in general, once you sign up for a plan, you are locked into that coverage for 12 months, or until the next Open Enrollment period. A change in health status doesn’t make you eligible for a special enrollment opportunity.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

What health benefits are covered under Marketplace plans?

All qualified health plans offered in the Marketplace will cover essential health benefits. Categories of essential health benefits include:

• Ambulatory patient services (outpatient care you get without being admitted to a hospital)

• Emergency services

• Hospitalization

• Maternity and newborn care (care before and after your baby is born)

• Mental health and substance use disorder services, including behavioral health treatment

• Prescription drugs

• Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

• Laboratory services

• Preventive and wellness services and chronic disease management

• Pediatric services, including dental and vision care

The precise details of what is covered within these categories may vary somewhat from plan to plan.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

How can I find out if a Marketplace plan covers the prescription drugs that I take?

Health plans in the Marketplace must include a link to their prescription drug “formulary” with other on-line information about the plan. The “formulary” is a list of prescription drugs the plan will cover. Before you select a plan you should check to see if the medications that you take are on the formulary and how much your co-payment will be. If you don’t find your drug on the formulary or if the copayment is unaffordable for you, but your doctor says it’s medically necessary for you to take a specific drug, you should carefully consider whether or not that plan is right for you.

Adapted from ://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Coverage Requirements

Can I be denied insurance?

Starting January 1 of 2014, insurance companies will not be able decline your application for health insurance because you have a pre-existing medical condition, or for any other health-related reason.

https://www.ehealthinsurance.com/affordable-care-act/faqs

What kinds of coverage count as Minimum Essential Coverage to satisfy the requirement to have health insurance?

Most people with health coverage today have a plan that will count as minimum essential coverage. The following types of health coverage count as minimum essential coverage:

- Employer-sponsored group health plans

- Union plans

- COBRA coverage

- Retiree health plans

- Non-group health insurance that you buy on your own, for example, through the health insurance Marketplace

- Student health insurance plans

- Grandfathered health plans

- Medicare

- Medicaid

- The Children’s Health Insurance Program (CHIP)

- TRICARE (military health coverage)

- Veterans’ health care programs

- Peace Corps Volunteer plans

Adapted from http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Do private insurance policies have to be labeled to show whether they are Minimum Essential Coverage?

All health insurers and employer-sponsored group health plans must provide people with a Summary of Benefits and Coverage, which uses a standard format to outline the benefits, cost-sharing and coverage limits of plans. The Summary of Benefits and Coverage must also say whether the plan meets minimum value and counts as minimum essential coverage, although in 2014, that information may be provided separately in a cover letter.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions

I notice that “Catastrophic Plans” that look even cheaper. What are those and can I buy one if I want

Insurers can offer “Catastrophic” plans. Catastrophic plans have the highest cost sharing. In 2014, catastrophic plans will have an annual deductible of $6,350 ($12,700 in family plans). You will have to pay the entire cost of covered services (other than preventive care) until you’ve spent $6,350 out of pocket; after that your plan will pay $15,521 of covered services for the rest of the year. Not everybody will be allowed to buy Catastrophic plans. They are only for adults up to age 30, and for older people who can’t find any other Marketplace policy that costs less than 8 percent of their income.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I notice short-term policies are for sale outside of the Marketplace and they are much cheaper than many other policies. What is a short-term policy? If I buy a short-term policy, does that satisfy the requirement to have Minimum Essential Coverage?

As the name implies, a short-term health insurance policy offers coverage for a period of less than 12 months (e.g., many offer coverage for just 6 months) and are renewable at the option of the insurance company. Though you may be given an opportunity to request to renew the policy, if you’ve made claims since you bought it, the insurer can refuse to renew it. This is also called a non-guaranteed-renewable policy. Short-term policies are not considered minimum essential coverage. Insurance companies that sell such policies are required to notify you that they do not constitute minimum essential coverage.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Dental care

Is dental coverage an essential health benefit?

Under the health care law, dental insurance is treated differently for adults and children 18 and under. Dental coverage for children is an essential health benefit. This means it must be available to you, either as a covered benefit under your health plan or as a free-standing plan. This is not the case for adults. Insurers don’t have to offer adult dental coverage.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions

I’m buying coverage on the Marketplace for my family. I notice many health plans don’t cover pediatric dental care, but there are also stand-alone dental plans for sale. Is that allowed?

Each health insurance Marketplace can decide whether to require all insurers to cover pediatric dental benefits or whether to allow the sale of stand-alone dental policies. When stand-alone dental policies are allowed, health insurers in the Marketplace might not be required to cover pediatric dental benefits. If your health plan covers dental benefits, you will pay one premium for everything. If you get dental benefits through a stand-alone plan, you will have to pay a separate premium for the dental benefits.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

It looks like pediatric dental benefits are only offered through stand-alone plans in my state Marketplace. Will my tax credit premium cover the cost of the stand-alone dental plan?

No, the premium tax credit will not be increased to also cover the cost of a stand-alone dental plan.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I can’t afford the cost of a stand-alone dental plan in addition to buying major medical health insurance. Will I owe a penalty for not having Minimum Essential Coverage if I don’t buy the separate dental plan?

No. You do not need to have pediatric dental coverage to avoid the penalty.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Your Premium Cost

Will I pay more for insurance if I’m unhealthy?

Starting on January 1 of 2014, insurance companies will not be able to charge higher rates to people within the same age group based on their gender or health status. And, if you buy your own health insurance, your application for coverage cannot be declined because you have a pre-existing condition, or for any other health related reason – beginning in 2014.

And, insurers will only be able to price plans based on four factors:

- Your age – the oldest person can only be charged three times more than the youngest person for the same plan.

- Where you live – the price to deliver care changes from city to city and state to state

- The size of your family

- And your tobacco use – a smoker can be charged up to 50% more for the same plan as a non-smoker.

https://www.ehealthinsurance.com/affordable-care-act/faqs

Can I be charged more if I have a pre-existing condition?

No. Starting in 2014, as insurance policies are sold or renewed, health plans are not allowed to charge you more based on your health status or pre-existing condition.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Can be charged more because of my age?

Yes, in most states you can, within limits. Federal rules allow insurers to charge older adults (e.g., in their sixties) up to three times the premium they would charge younger adults (e.g., in their early twenties). This limit on age rating applies to all non-group and small-group health insurance policies, whether sold in the Marketplace or outside of the Marketplace. Some states prohibit insurers from adjusting premiums for age, or limit the age adjustment to less than three-to-one.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I smoke cigarettes and I buy my own health insurance. Can I be charged more because I smoke?

Yes, in most states you can. Insurers are allowed to increase premiums by up to 50% more for people who use tobacco, although many insurers apply a lower surcharge for tobacco use. If you qualify for premium tax credits, this tobacco surcharge will not be covered by the tax credit. States are allowed to limit tobacco surcharges and a few have decided to prohibit tobacco rating by health insurers.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

Paying your Exchange Premium

I’ve picked the plan I want. Now do I send my premium to the Marketplace?

No, you will make your premium payments directly to the health insurance company. Once you’ve selected your plan, the Marketplace will direct you to your insurance company’s website to make the initial premium payment. Insurance companies must accept different forms of payment and they cannot discriminate against consumers who do not have credit cards or bank accounts. The insurance company must receive and process your payment at least one day before coverage begins. Make sure you understand your insurance company’s payment requirements and deadlines and follow them so your coverage begins on time. Your enrollment in the health plan is not complete until the insurance company receives your first premium payment.

Note that if you have qualified to receive an advanced premium tax credit, the government will pay the credit directly to your insurer and you will pay the remainder of the premium directly to the insurer.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions

What happens if I’m late with a monthly health insurance premium payment?

The answer depends on whether you are receiving advanced premium tax credits. For people receiving advanced premium tax credits, if a payment due date is missed, insurers must provide a 90-day grace period during which consumers can bring their premium payments up to date and avoid having their coverage terminated. However, the grace period only applies if an individual has paid at least one month’s premium. If, by the end of the 90-day grace period, the amount owed for all outstanding premium payments is not paid in full, the insurer can terminate coverage.

In addition, during the first 30 days of the grace period, the insurer must continue to pay claims. However, after the first 30 days of the grace period, the insurer can hold off paying any health care claims for care received during the grace period, which means the enrollee may be responsible to cover any health care services they receive during the second and third months if they fail to catch up on the amounts they owe before the end of the grace period. Insurers are supposed to inform health care providers when someone’s claims are being held. This could mean that providers will not provide care until the premiums are paid up so that they know they will be paid.

Adapted from http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I’m behind on my payments and trying to catch up, but meanwhile I got sick and so had to make more health care claims. Does my health plan have to pay them??

If you are receiving advanced premium tax credits, the insurer is required to pay your claims during the first 30 days of the grace period. After that, during the second and third month of the grace period, the insurer is allowed to hold your claims and only pay them if and when you get caught up in your premium payments.

My income is very low, so I’m only required to pay about $30/month for my health insurance premium. The tax credit picks up the rest, which is more than 90 percent of the total premium. I’ve missed 4 premium payments in a row. Can the insurance company cancel my coverage even though they got 90 percent of the payment on time from the IRS?

Yes. A person receiving an advanced premium tax credit has a 90-day grace period to pay all premiums that are owed. If the amount owed for all outstanding premium payments is not paid in full by the end of the grace period, the insurer can terminate coverage. The insurer would then have to return funds it received from the federal government for all but the first 30 days of the grace period.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

How does The Affordable Care Act affect my HSA account?

The Affordable Care Act did make some changes to Health Savings Accounts – also called HSAs – and how they will work. First, the law eliminated your ability to use money in their HSA account to buy over-the-counter drugs. The second big change is that the law increased the penalty for withdrawing funds from your HSA before you reach age 65. The early withdrawal penalty increased from 10% to 20%.

https://www.ehealthinsurance.com/affordable-care-act/faqs

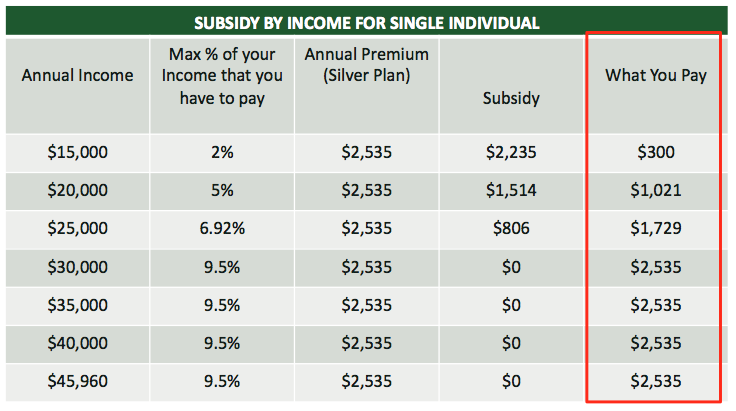

Why does my household income matter under the Affordable Care Act?

The government utilizes your household’s combined Modified Adjusted Gross Income, or MAGI as a basis to determine your eligibility for a government health insurance subsidy under the Affordable Care Act. For most people, MAGI is the same as your Adjusted Gross Income (entered on your most recent tax return) https://www.ehealthinsurance.com/affordable-care-act/faqs

Insurance Penalty

What’s the penalty for not having health insurance?

If you’re uninsured for more than three months in 2014, you may incur the tax penalty and that penalty would be applied when you file your 2014 income tax return.

The penalty is phased-in over a three-year period.

- In 2014, the penalty will be the greater of 1.0% of taxable income or $95 per adult and $47.50 per child (up to $285 per family).

- In 2015, the penalty will be the greater of 2.0% of taxable income or $325 per adult and $162.50 per child (up to $975 per family).

- In 2016, the penalty will be at the greater of 2.5% of taxable income or $695 per adult and $347.50 per child (up to $$2,085 per family).

- After 2016, the penalty will be increased annually by the increase to the cost-of-living.

Households with incomes above $46,680 of FPL will be exempt from paying tax penalties if insurance in their area costs more than 8% of their taxable income, after taking into account employer contributions or tax credits.

Adapted from https://www.ehealthinsurance.com/affordable-care-act/faqs

I’m uninsured. Am I required to get coverage in 2015?

Everyone is required to have health insurance coverage – or more precisely, “minimum essential coverage” – or else pay a tax penalty, unless they qualify for an exemption. This requirement is called the individual responsibility requirement, or sometimes called the individual mandate.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

How do I prove that I had coverage and satisfied the mandate?

When you file your 2014 tax return (most people will do this by April 15, 2015) you will have to enter information about your coverage (or your exemption) on the return. You should get a notice from your insurance provider by January 31, 2015, describing your coverage status during the previous year.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I had several short coverage gaps in a year – I was uninsured in March, then again in August. Since the total gap was less than 3 months, am I exempt from the penalty

The rule for short coverage gaps is that only the first short coverage gap in a year will be recognized. You wouldn’t be penalized for lacking coverage in March, but you may owe a penalty for your second gap in coverage in August if you don’t otherwise qualify for an exemption during that period.

Apparently my family isn’t eligible for subsidies in the Marketplace because I am eligible for self-only coverage at work that is considered affordable. But we can’t afford to buy Marketplace coverage on our own. Will I have to pay a penalty because my family members are uninsured?

No. Because the amount you would have had to pay to actually cover your spouse and kids was more than 8% of your family income, they won’t be penalized for not having health coverage.

If I owe a penalty, when and how do I have to pay it?

If you do not maintain minimum essential coverage in 2014 and you don’t qualify for an exemption you will need to pay a “shared responsibility payment” to the IRS on your 2014 tax return. If you are like most people, you will need to submit your return by April 15, 2015.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

On what grounds can I apply for a hardship exemption to the individual mandate?

You may apply for a hardship exemption if you have experienced difficult financial or domestic circumstances that prevent you from obtaining coverage – such as homelessness, death of a close family member, bankruptcy, substantial recent medical debt, or disasters that substantially damage a person’s property. People may also apply for a hardship exemption if obtaining coverage would be so burdensome as to cause the applicant to experience other serious deprivation of food, shelter, or other necessities. Consult your Marketplace for more information about hardship exemptions.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

How do I apply for an exemption?

• For some types of exemptions, you must apply through the health insurance Marketplace; for other types, you must apply when you file your taxes; some types of exemptions can be claimed either way.

- The religious conscience exemption and most hardship exemptions are available only by going to a health insurance marketplace and applying for an exemption certificate.

- The exemptions for members of Indian tribes, members of health care sharing ministries, and individuals who are incarcerated are available either by going to a Marketplace and applying for an exemption certificate or by claiming the exemption as part of filing a federal income tax return.

- The exemptions for unaffordable coverage, short coverage gaps, certain hardships and individuals who are not lawfully present in the United States can be claimed only as part of filing a federal income tax return. The exemption for those under the federal income tax return filing threshold is available automatically. No special action is needed.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions