You are eligible for Medicare if:

- You are 65 or older (some exclusions)

- You are younger than 65 and have certain disabilities and illnesses

- You have kidney failure that requires dialysis or a kidney transplant.

- Open enrollment: October 15 – December 7.

- You can select the Medicare Advantage plan of your choice.

- Medicare uses information from member satisfaction surveys, plans, and health care providers to give overall performance STAR RATINGS to plans.

- A plan can get a rating between 1 and 5 stars.

- A 5-star rating is considered excellent.

- These ratings help you compare plans based on quality and performance.

- The ratings are updated each fall and can change each year.

You can sign up for a five-star plan anytime during the year, but there’s a catch…In 2014 only 14 Medicare Advantage plans were awarded 5 stars.

Medicare Coverage

- Medicare Part A is Hospital Inpatient Coverage

- Medicare Part B is Outpatient Coverage

- Medicare Part C is Medicare Advantage-which combines Medicare Part A and Medicare Part B

- Medicare Part D is for Prescription Drug Coverage

What are STAR RATINGS?

- A plan can get a rating between 1 and 5 stars.

- A 5-star rating is considered excellent.

- These ratings help you compare plans based on quality and performance.

- The ratings are updated each fall and can change each year.

You can sign up for a five-star plan anytime during the year, but there’s a catch. In 2014 only 14 Medicare Advantage plans were awarded 5 stars.

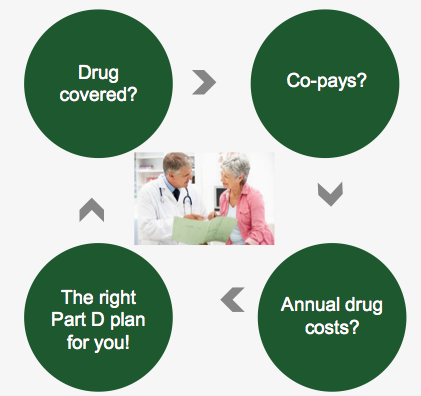

Medicare Part D Coverage

There are some key considerations to take into account when you select your Part D plan:

- Are your medications covered on the plan(s) you’re considering. (Check plan formulary drug lists to see if your drugs are covered)

- How much will you pay in co-pays.

- How much will your prescriptions cost?

Medigap Coverage

Medigap coverage covers the co-payment gap

- You must have Medicare Part A and Part B

- If you have a Medicare Advantage plan, you can

apply for a Medigap policy, but you must leave the

Medicare Advantage plan before your Medigap policy begins - You pay a private insurance company a monthly premium for your medigap policy in addition to the monthly Part B premium that you pay to Medicare.

Traditional Medicare Coverage

- Includes Part A (hospital) and Part B (medical) coverage (requires enrolling in both)

- Deductibles and/or coinsurance for health care services apply (usually 20% of the Medicare-approved cost for outpatient care)

- Most people pay a monthly premium for Part B. Part A carries no premium if you have worked in the U.S. for at least 10 years.

- There are no networks. You can go to any doctor or hospital in the country that accepts Medicare.

- No referral required for specialists; no prior authorization required for services.

Medicare Advantage Coverage

- Medicare Advantage includes Part A (hospital) and Part B (medical) coverage

- You pay no premium for Part A and you receive hospital insurance benefits and pay a deductible of $1,200 for up to 60 days in the hospital

- You pay a premium of $147 per month and Medicare pays 80% of Outpatient charges and you pay 20%.

- You receive care only from doctors and hospitals who accept insurance from the Medicare Advantage plan that you select

Medicare Part D: How much will prescription drugs cost?

Medicare Plans

I am enrolled in a Medicare Part D drug plan. Did the Affordable Care Act make changes to my Medicare drug coverage?

- Yes, the law included changes that could save you money if you have very high prescription drug costs. If you are enrolled in a Medicare Part D plan and you have very high drug costs, the law is helping to reduce the costs you pay when you reach a gap in coverage that is sometimes referred to as the “doughnut hole.” This gap in coverage is being phased out between now and 2020. If your total drug costs are more than $2,850 in 2014, after that point you will pay 47.5% of the cost of your brand-name drugs and 72% of the cost of your generic drugs. These amounts are gradually being lowered to 25% for both brdan-name and generic drugs by 2020.

http://kff.org/health-reform/

I am enrolled in a Medicare Advantage plan. Did the Affordable Care Act make changes to this program?

- Yes, the law did make some changes to the Medicare Advantage This program is an alternative to traditional Medicare, where people on Medicare can choose to enroll in a private plan, such as an HMO or PPO, to receive your Medicare-covered benefits. The law reduced payments to these plans to bring them closer to the average costs of traditional Medicare. But rest assured that your plan is still required to provide all benefits that are covered by traditional Medicare. But your plan might charge higher premiums, increase the cost-sharing amounts that you pay for services, reduce the number of providers in the plan’s network, or reduce additional benefits that the plan might cover, such as dental exams or eyeglasses.

http://kff.org/health-reform/

Medicare and the Exchange Marketplace

Will the open enrollment period be the same for Medicare and the new marketplaces?

There is some overlap in the enrollment periods for Medicare and the marketplaces, but this year they are not the same. The Medicare open enrollment period runs from October 15 through December 7 each year. For 2015, the open enrollment period for the health insurance marketplace will run from November 15, 2014 through February 15, 2015. Next year and every year after that, the marketplace open enrollment period will be the same as the Medicare open enrollment period.

http://kff.org/health-reform/

I am in my early 60s and plan to sign up for a marketplace plan so that I have health insurance coverage until I qualify for Medicare at age 65. What happens when I go on Medicare?

- When you turn 65, you should sign up for Medicare and notify your marketplace plan that you now qualify for Medicare coverage. If you receive premium tax credits to help you pay for your marketplace plan premium, those tax credits will end when your Medicare coverage starts (the premium tax credit can only be used for the purchase of marketplace coverage, not Medicare). You can start signing up for Medicare three months before your 65th birthday. Make sure your Medicare coverage has started before you drop your marketplace plan so that you avoid any gaps in coverage.

http://kff.org/health-reform/

I am 65 years old, but I am not entitled to Medicare because I did not work long enough to qualify. Can I sign up for a marketplace plan?

Yes, in general, people age 65 or older who are not entitled to Medicare can purchase health insurance coverage in the marketplace (except undocumented immigrants). If you sign up for a marketplace plan, you will be eligible for premium tax credits to make the coverage in the marketplace more affordable if your income is between $15,521 and $46,680.

http://kff.org/health-reform/

I am 66 years old, work for a large employer, and have excellent health insurance coverage through my job. I am planning to keep working for a few more years and would like to keep the coverage that my employer offers. How does the marketplace affect me?

It doesn’t. You can keep your employer-sponsored health insurance coverage as long as that is an option for you. Since you are already eligible for Medicare because you are over age 65, you should sign up for Medicare when you stop working or if you lose your employer coverage before then. Once you decide when you want to stop working, you should contact the Social Security Administration about how and when to enroll in Medicare to be sure you don’t have a gap in coverage.

http://kff.org/health-reform/

I am about to turn 65 and go on Medicare, and my income is $100,000. I know that people with higher incomes are required to pay higher premiums for Medicare Part B and Part D. To avoid paying these higher Medicare premiums, can I sign up for health insurance from a marketplace plan instead of enrolling in Medicare when I turn 65?

The ACA does not explicitly prohibit someone who is eligible for or enrolled in Medicare from buying health insurance through the marketplace. But insurers are prohibited from selling health insurance coverage that duplicates what you have under Medicare, if they know you are covered by Medicare.

If you are considering this choice, keep in mind premiums for marketplace policies are based on age. Even bronze plans, with very high deductibles, would cost $4,000 or more per year for a person 65 or older, depending on where you live, and might not cover all the providers available under Medicare. If you sign up for a marketplace plan, rather than enroll in Medicare Part B when you are first eligible to do so, and then later you decide to sign up for Medicare, you may be required to pay a penalty for delaying enrollment in Medicare Part B. A late enrollment penalty for Medicare Part D drug coverage might also apply, depending on whether the drug coverage you had through your marketplace plan was as good as the standard Part D drug benefit.

http://kff.org/health-reform/

I am covered by Medicare and my annual income is $30,000. Can I qualify for a premium tax credit to help me pay for my health insurance coverage through Medicare?

No. People on Medicare are not eligible for the premium tax credits, no matter what their income level.

http://kff.org/health-reform/

I am 54 and living with a permanent disability, and for the past 12 months I have been receiving (SSDI) payments. But I do not have health insurance. I am required to wait another 12 months before I can go on Medicare due to the two-year waiting period for people receiving SSDI payments. Am I eligible to purchase health insurance coverage from a marketplace plan under Affordable Care Act? Am I eligible for a premium tax credit? And what about Medicaid?

Yes, you are eligible to purchase coverage through the marketplace, and if your income is between 100% and 400% of poverty (about $15,521 to $46,680 for an individual in 2014) you will qualify for premium tax credits to help make marketplace coverage more affordable. If you live in a state that expands its Medicaid program to cover adults under age 65 with incomes up to $14,404, you might also be eligible for this coverage, depending on your income.

- If you apply for and receive marketplace coverage and subsidies, remember that once you become eligible for Medicare, your eligibility for marketplace subsidies will end. At that point, you will be able to drop your marketplace coverage and enroll in Medicare Part A, Part B and Part D.

http://kff.org/health-reform/

Medicare Star Ratings

What are the Medicare Star Ratings?

Medicare uses a Star Rating System to measure how well Medicare Advantage and prescription drug (Part D) plans perform. Medicare scores how well plans did in several categories, including quality of care and customer service. Ratings range from 1 to 5 stars, with five being the highest and one being the lowest score. Medicare assigns plans one overall star rating to summarize the plan’s performance as a whole. Plans also get separate star ratings in each individual category reviewed. The overall star rating score provides a way to compare performance among several plans. To learn more about differences among plans, look at plans’ ratings in each category.

Medicare reviews plan performances each year and releases new star ratings each fall. This means plan ratings change from one year to the next. Medicare sets the categories and reviews each plan the same way. You should look at coverage and plan costs, such as if the Part D plan covers all the drugs you take and has a premium you can afford before you consider the star rating.

Medicare health plans are rated on how well they perform in five different categories:

- Staying Healthy: Screenings, Tests, and Vaccines

- Managing Chronic (Long-Term) Conditions

- Plan Responsiveness and Care

- Member Complaints, Problems Getting Services, and Choosing to Leave the Plan

- Health Plan Customer Service

Medicare drug plans are rated on how well they perform in four different categories:

- Drug Plan Customer Service

- Member Complaints, Problems Getting Services, and Choosing to Leave the Plan

- Member Experience with Drug Plan

- Drug Pricing and Patient Safety

Where can I find information on my plan’s star rating?

The star ratings can be found in the Medicare Plan Finder tool (www.medicare.gov/find-a-plan) or by calling 800-MEDICARE. New plan quality ratings come out each October and apply to the next calendar year (for example, plan ratings for 2015 will be available in October of 2014).

Note: The quality ratings stars found on Plan Finder and by calling 800 Medicare are the most up-to-date and may differ from the ratings listed in the Medicare and You handbook you received in the mail.

How can I use the star ratings to inform my plan choice this year?

A plan’s star ratings is only one factor to look at when you compare plans in your area. Even though a plan has a high star rating, it may not be right for you. You must also consider how much the plan is going to cost, and if it covers all the drugs and services you need and includes the pharmacy you need in its preferred network.

If Medicare gives a plan less than three stars (only one or two stars) for three years in a row, Medicare’s Plan Finder tool will flag the plan as low performing. The flag looks like a caution sign; an upside down red triangle with an exclamation point inside of it. You cannot use the Plan Finder tool to enroll into one of these low-performing plans. You will have to call the plan directly to enroll. If you are enrolled in a plan that gets one or two stars for three years in a row, Medicare will mail you a letter telling you this. You will not be removed from the plan, but if you receive this letter, check the plan’s costs and coverage to make sure it is still a good plan for you.

INSURANCE PENALTY

What’s the penalty for not having health insurance?

If you’re uninsured for more than three months in 2014, you may incur the tax penalty and that penalty would be applied when you file your 2014 income tax return.

The penalty is phased-in over a three-year period.

- In 2014, the penalty will be the greater of 1.0% of taxable income or $95 per adult and $47.50 per child (up to $285 per family).

- In 2015, the penalty will be the greater of 2.0% of taxable income or $325 per adult and $162.50 per child (up to $975 per family).

- In 2016, the penalty will be at the greater of 2.5% of taxable income or $695 per adult and $347.50 per child (up to $$2,085 per family).

- After 2016, the penalty will be increased annually by the increase to the cost-of-living.

Households with incomes above $46,680 of FPL will be exempt from paying tax penalties if insurance in their area costs more than 8% of their taxable income, after taking into account employer contributions or tax credits.

Adapted from https://www.ehealthinsurance.com/affordable-care-act/faqs

I’m uninsured. Am I required to get coverage in 2015?

Everyone is required to have health insurance coverage – or more precisely, “minimum essential coverage” – or else pay a tax penalty, unless they qualify for an exemption. This requirement is called the individual responsibility requirement, or sometimes called the individual mandate.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

How do I prove that I had coverage and satisfied the mandate?

When you file your 2014 tax return (most people will do this by April 15, 2015) you will have to enter information about your coverage (or your exemption) on the return. You should get a notice from your insurance provider by January 31, 2015, describing your coverage status during the previous year.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

I had several short coverage gaps in a year – I was uninsured in March, then again in August. Since the total gap was less than 3 months, am I exempt from the penalty?

The rule for short coverage gaps is that only the first short coverage gap in a year will be recognized. You wouldn’t be penalized for lacking coverage in March, but you may owe a penalty for your second gap in coverage in August if you don’t otherwise qualify for an exemption during that period.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

If I owe a penalty, when and how do I have to pay it?

If you do not maintain minimum essential coverage in 2014 and you don’t qualify for an exemption you will need to pay a “shared responsibility payment” to the IRS on your 2014 tax return. If you are like most people, you will need to submit your return by April 15, 2015.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

On what grounds can I apply for a hardship exemption to the individual mandate?

You may apply for a hardship exemption if you have experienced difficult financial or domestic circumstances that prevent you from obtaining coverage – such as homelessness, death of a close family member, bankruptcy, substantial recent medical debt, or disasters that substantially damage a person’s property. People may also apply for a hardship exemption if obtaining coverage would be so burdensome as to cause the applicant to experience other serious deprivation of food, shelter, or other necessities. Consult your Marketplace for more information about hardship exemptions.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions/

How do I apply for an exemption?

- For some types of exemptions, you must apply through the health insurance Marketplace; for other types, you must apply when you file your taxes; some types of exemptions can be claimed either way.

- The religious conscience exemption and most hardship exemptions are available only by going to a health insurance marketplace and applying for an exemption certificate.

- The exemptions for members of Indian tribes, members of health care sharing ministries, and individuals who are incarcerated are available either by going to a Marketplace and applying for an exemption certificate or by claiming the exemption as part of filing a federal income tax return.

- The exemptions for unaffordable coverage, short coverage gaps, certain hardships and individuals who are not lawfully present in the United States can be claimed only as part of filing a federal income tax return. The exemption for those under the federal income tax return filing threshold is available automatically. No special action is needed.

http://kff.org/health-reform/faq/health-reform-frequently-asked-questions